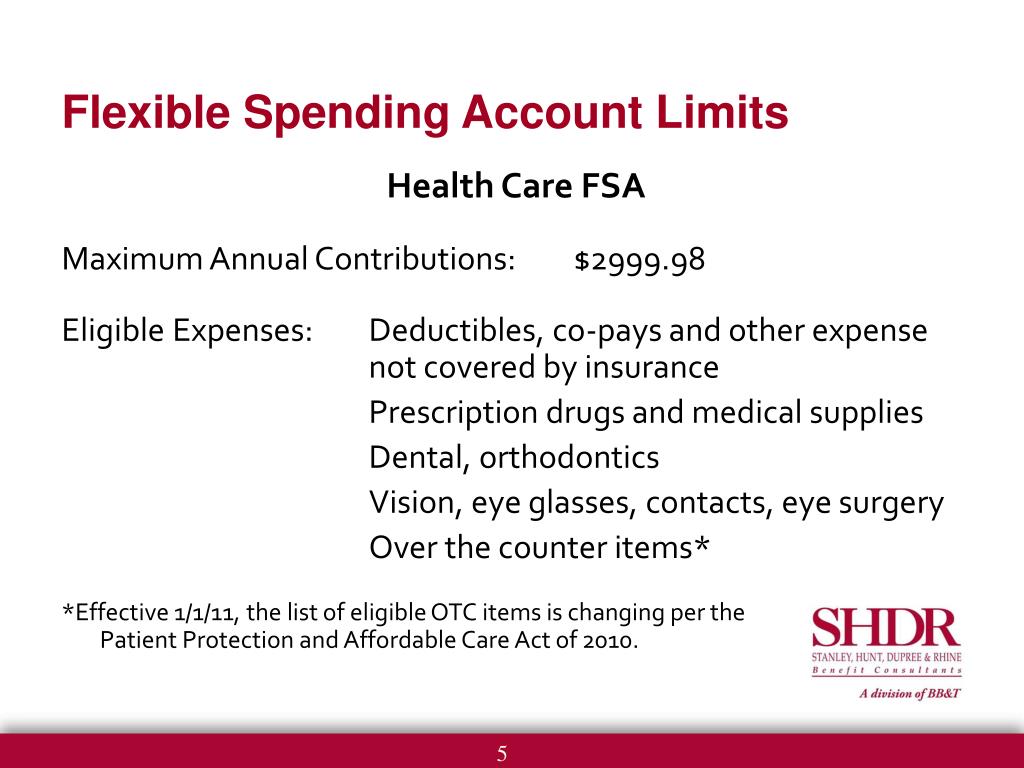

The upside? You can skip the extensive research by shopping at the FSA Store. A flexible spending account (FSA) is an account that allows you to save pre-tax dollars and use them toward your medical and dependent care expenses. Flexible expenses, also known as variable expenses, are different from periodic expenses, which are set costs that occur at regular intervals. The downside is that the specifics of what you can spend your FSA funds on depend on the plan your employer has in place. Conclusion What is a Flexible Expense A flexible expense is a cost that can vary from month to month, depending on your income and needs. A flexible spending account (FSA), also known as a flexible spending arrangement, is a special account you can use to pay for certain out-of-pocket healthcare costs. Everything from medical expenses that aren’t covered by a health plan (like deductibles and co-pays to dependent day care) to over-the-counter medication can also be eligible. But you’ll want to check with your employer, because grace periods can be shorter.Ĭommon purchases include everyday health care products like bandages, thermometers and glasses. The good news is that many employers provide a grace period of up to two and a half months into the new year for you to use the money, giving you until March 15 to spend it all. So it’s important to keep in mind the annual Dec. The unused amount left in your account can’t be paid out to you in any other way, and you can’t transfer money to any other FSA. Most FSA participants are part of a “use it or lose it” plan, which states that all the money left in your account by the end of the year must be forfeited. Why do I have to spend my FSA dollars before a certain date? While the specific amount differs depending on your tax bracket, there are calculators available to help you estimate your savings amount. The money that you contribute to a dependent care FSA lowers your taxable income for the year, but you must use the funds within a certain period of time. This pretax money is for FSA spending, and is meant to be used on eligible health care expenses throughout the year. Key takeaways: A dependent care flexible spending account (DCFSA) allows qualified individuals to pay for child and dependent care expenses completely tax-free, up to a certain limit. With each paycheck you receive, a certain amount of money is put aside before taxes. If you’re not sure exactly what an FSA is and why it’s important that you spend your pretax dollars, we’ve got you covered with a quick guide.Ī flexible spending account (FSA) is offered through many employer benefit plans and allows you to set aside pretax money for eligible health care-related, out-of-pocket expenses for you, your spouse and dependents. That’s why we’ve rounded up a quick and easy list of products available in the FSA Store, offers which are offers more than 4,000 FSA eligible items. But if there’s still money in your flexible spending account (FSA), you better spend those pretax FSA funds quickly before the deadline hits and they all disappear.

When risk increases the return on investment must also increase. Risk and return increase or decrease together. So, flexible expenses vary from month to month. You bought new eyeglasses, squeaked in a dental appointment and stocked up on over-the-counter drugs. Flexible as the name is is something that can change from time to time. As such, discretionary expenses rarely have anything to do with a business or household's day-to-day operations and, instead, have to do with lifestyle and choice.Your CNN account Log in to your CNN account These are generally considered wants, while non-discretionary expenses are usually referred to as needs. Office of Personnel Management and administered by HealthEquity, Inc. While non-discretionary expenses are considered mandatory-housing, taxes, debt, and groceries-discretionary expenses are any costs incurred above and beyond what is deemed necessary. The Federal Flexible Spending Account Program (FSAFEDS) is sponsored by the U.S.

Discretionary expenses vary depending on the business or person.Įxpenses are divided into several categories, namely non-discretionary and discretionary.Tracking discretionary expenses enables businesses and households to identify where they can save money in times of financial difficulties.In a corporate environment, discretionary expenses are usually costs linked with improving a company’s reputation among its customers and employees.A discretionary expense is a cost that is not essential for the operation of a home or a business.

0 kommentar(er)

0 kommentar(er)